In the last post, I covered the potential benefits of Financial Independence Retire Early (FIRE). Today I present the potential downsides.

You spend too much time working during prime years

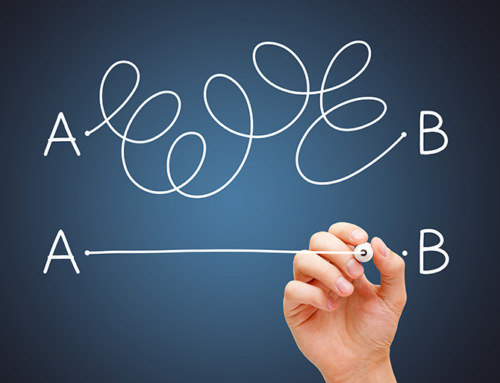

FIRE may end up being a “penny wise and dollar foolish” strategy. This means that if you single-mindedly pursue working your “day job,” you may not have time or energy to pursue entrepreneurial endeavors or investment strategies, both of which require a large investment in time and focus. I once told a physician friend of mine, “You’re too busy to get rich.” This is an expression of the concept of opportunity cost; if you pursue one thing, you give up pursuing another, perhaps more valuable, thing.

You focus too much on making and saving and investing money

When you spend the “best years of your life” focusing on work and money, you are at risk of losing connection with what might be most important to thriving. You might inadvertently end up living a life of self-denial. You might put off making and nurturing friendships, dating, getting married, having kids, or pursuing creative or philanthropic endeavors until you decide you’ve reached financial independence. And by then it might be too late.

Work can increasingly be seen as a negative

Since with FIRE, the focus is on early retirement, work can increasingly be experienced as bad or painful. Since it is what must be overcome to achieve early retirement, it is experienced as an obstacle, something to escape from as soon as possible.

This mindset then constrains what and how one experiences one’s daily activities, possibly missing out on all that is generative, meaning-giving, purposeful, joyous, and good in one’s work. Thus, when the good aspects come to be ignored or unseen, it can more easily lead to burnout. After all, once the good is no longer perceived in all its vividness, then what is left? Just the endless hassles. Then as burnout sets in, the follower of FIRE is even more focused on “getting the hell out.” This describes a vicious cycle and like most of them, it is self-inflicted.

Devoting Yourself to FIRE Forms YOU

Following a FIRE lifestyle changes what you value, what you find salient, what you attend to in your environment, how you judge various options and people, how you make choices, and how you act. All this leads to a change in who you are – how others see you and how you see yourself. It changes your identity and self-concept.

This does not necessarily lead to a bad or worse self, but it does lead to a different self. I wish here to point out the deep ramifications that a pursuit of FIRE can result in. Be aware and prepared. Don’t end up in a place you never wished to end up at.

When you achieve FIRE, then what?

Many – definitely not all – people I’ve discussed FIRE with are motivated by no longer needing to work. This has two meanings: 1) stopping work and retiring early or 2) working while having the financial resources to not having to work, to have the ability to tell your boss to “take this job and shove it!”

While I do not wish to minimize these as reasons, I do wish to raise the question of “What then?” You don’t want to be the dog that chased and caught the car.

Once financial independence is achieved, what do you do with yourself then? Here are the possibilities of what might happen:

- You retire early and live the life of your dreams, without regrets.

- You retire early, find it boring and unfulfilling, and return to work in your profession or perhaps in some other area of endeavor.

- Or you just keep on working as you’ve always worked: hard, long, focused on building up that financial nest egg. In effect, FIRE has become a lifelong lifestyle and not a means to an end that actually ends.

To successfully retire early and feel good about it, you have to give up the FIRE lifestyle and the FIRE self-concept. You also need to have the interests, skills, relationships, connections, and things you value to succeed in your new life, one no longer focused on working hard to make money to save and invest. But all those years of the FIRE lifestyle may have left you poorly equipped to succeed at or enjoy your post-retirement lifestyle. FIRE is all that you might have known for decades.

I bring this up because this is a solvable situation, but to be solvable it should be considered from the start. Often it isn’t and leaves the pursuer of FIRE ill-equipped to move towards and succeed at what they thought they’ve always wanted.

I will conclude here. I have more things to share about FIRE, but I’ll spare you for now. Please write and tell me how right or wrong I am or tell me about your own successful or not successful experiences with FIRE. We can continue our conversation.

Thanks,

Dr. Jack

Leave A Comment